Each sector and, indeed, each company within the sector, will have different regulatory and record-keeping requirements. A pharmaceutical company will have very strict record-keeping requirements, for example. Revenue will accept records that are produced within a company’s own internal record-keeping procedures. However, it is crucial that some kind of systematic approach is implemented. As the R&D tax credit scheme keeps up with international equivalents in terms of legislation, we may see that Revenue increases its scrutiny of claims in line with other schemes across the globe.

Why You Can Trust Finance Strategists

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. R&D tax claims can include staff wages, materials, overheads, subcontractor turbotax free for military payments, agency staff and payments to universities and institutes of higher education. Some other costs can be included, such as royalty payments, rental costs and cloud computing costs, so long as they are incurred “wholly and exclusively” for R&D.

What is your current financial priority?

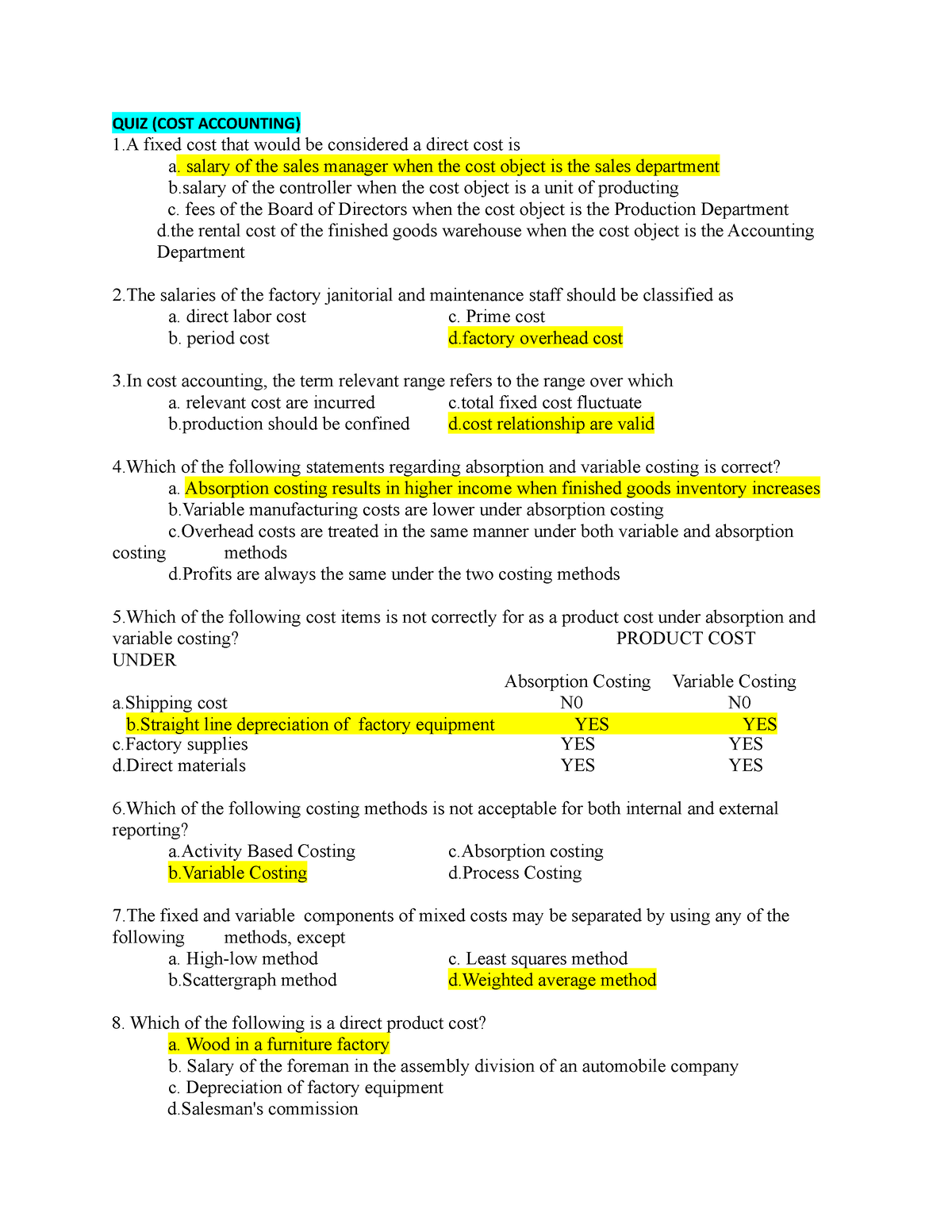

Accountants use the information to make decisions by analyzing data and trends. This information can come from Financial Statements, internal reports, surveys, and other sources. By analyzing this data, accountants can make informed decisions to help the company achieve its goals. Almost 700 unique accounting questions with PDF available inside with questions, answers, and explanations. Learn accounting and finance concepts fast and fun using contents from lessons covered in the Accounting Flashcards App. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

What records are required to pass the Accounting Test?

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- If you find any questions difficult, consider reading our introduction to accounting in the explanation section of the website.

- In accounting, decision-making is the process of choosing between two or more courses of action to achieve the desired outcome.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

If you find any questions difficult, consider reading our introduction to accounting in the explanation section of the website. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. We have experience in making claims from the micro to international scale and we know what’s needed to make a robust claim. If not, you should make an effort to see where project tracking documents can be introduced. This may include a series of questions at the commencement of any project, to determine if R&D is expected. Alternatively, you may implement monthly check-ins which review last month’s work and what new uncertainties may have arisen.

With the R&D tax credit claims value surpassing the billion mark for the first time in 2022, it seems likely that Revenue will be keeping a closer eye on claimants to make sure they aren’t giving money away. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Company

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. If you wish to take an accounting quiz please do so by first choosing a quiz from the Popular Quiz list below.

Of course, you only need to provide the records relevant to your costs. If you haven’t got any subcontractor payments, then you don’t need to provide evidence of this. Grant-funded companies must therefore retain all relevant records and ensure that they correctly claim for their R&D activities. Despite grant-funded small and micro-sized companies being exempt from the Science Test (provided they meet certain criteria), they must still pass the Accounting Test for the claim to be valid. The Accounting Test is part of how Revenue ensures that claims meet the qualification criteria. It’s a detailed examination into the costs claimed, performed by an expert from Revenue.

However, the allocation of costs is unrelated to the R&D grant, therefore Revenue reserves the right to investigate the cost and tax treatment applied by the company. Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify. Finance Strategists has an advertising relationship with some of the companies included on this website.