Effective and marginal tax rates are useful to calculate because they account for the multiple layers of taxes (such as the income tax and payroll tax) alongside relevant deductions and credits, says Reid. In Oregon, different tax brackets are applicable to different filing types. Married couples filing their Oregon income tax return jointly will usually have wider tax brackets than those filing separately or as an individual. Making sense of the tax landscape means comparing more than just one type of tax rate. From income to property to sales taxes — and all the other taxes in between — each state crafts a unique tax profile that can affect your wallet in different ways.

Tax rates and table

Simple Form 1040 returns only (no schedules except for Earned Income Tax Credit, Child Tax Credit and student loan interest). When we measure all these taxes together, experts at WalletHub term it the “tax burden.” It’s a clear way to see how much of your hard-earned money sticks with you after taxes. Here’s a look at states where residents’ wallets feel the pinch of taxes the most, and where they can breathe a bit easier. Now, on to the states with minimal or oregon income tax no income tax, which could mean more money in your pocket after tax season.

Calculate your take-home pay per paycheck for salary and hourly jobs after federal & Oregon taxes

Remember to examine all tax implications, including sales, property, and other state-specific taxes and fees. Where you call home isn’t just about proximity to work or the quality of local schools—it can also be about payroll the slice of income taken by state taxes. Income tax by state varies greatly, affecting everything from your paycheck to your day-to-day spending.

Oregon Widower Filer Tax Tables

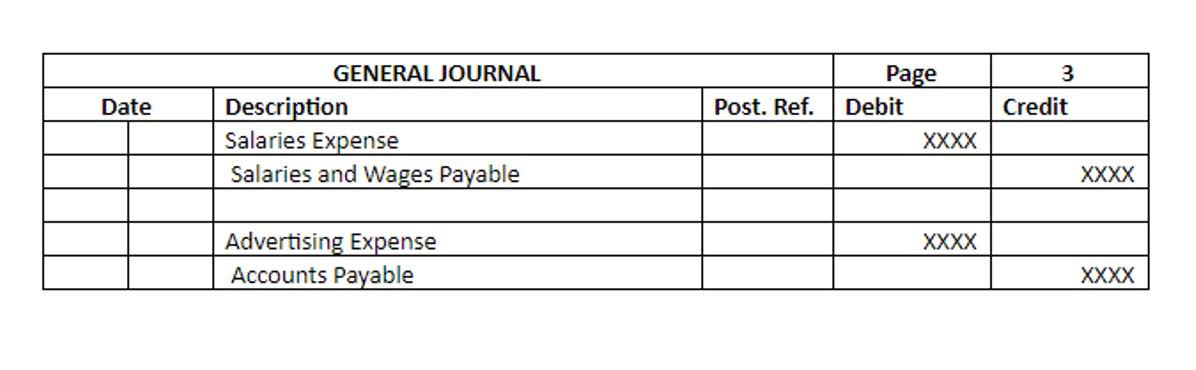

The Tax tables below include the tax rates, thresholds and allowances included https://www.bookstime.com/ in the Oregon Tax Calculator 2024. Deductions of all kinds can lower the amount of income we are taxed on (taxable income), while tax credits reduce the amount of tax owed (tax liability). Some credits are refundable, which means that if your bill is reduced to $0, you can get some or all of the remaining credit back as a refund. Everyone has the opportunity to reduce their gross income by a standard deduction or list certain major personal expenses one at a time, known as itemizing deductions.

TURBOTAX ONLINE/MOBILE

- If you’re interested in strategizing ways to minimize your taxes for the year ahead, you may want to hire a tax preparer who offers tax planning.

- Download Publication OR-ESTIMATE, for more information about estimated personal income tax payments.

- Kotek’s recommended budget asks for $15.7 billion in total spending for education including a $600 million increase to the state school fund for a total of $11.36 billion.

- While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

- However, some states may have different deadlines, and it’s worth checking the specifics for where you live, especially in years where the date might be pushed due to holidays or weekends.

- In other words, a minority of lawmakers — more easily captured by special interests — can block the will of the majority.

- While there are seven tax brackets for individual income and five filing statuses, corporate income is subject to a flat 21% tax rate.

It consists of four income tax brackets, with rates increasing from 4.75% to a top rate of 9.9%. Only a small subset of taxpayers actually pays that rate, however, as it applies only to single taxpayers making at least $125,000 a year ($250,000 for joint filers). The table below shows the full tax brackets and rates for the state income tax in Oregon. If your annual income is less than the standard deduction for your filing status, you generally won’t owe any federal income tax or need to file a federal income tax return.