So, in such a case, the insurance company finally decides to pay for the salvage value of the vehicle rather than fixing it. Owing to these factors, the companies need to make the asset cost-efficient. Besides, the companies also need to ensure that the goods generated are economical from the customer’s perspective as well. Overall, the companies have to calculate the efficiency of the machine to maintain relevance in the market.

How to Calculate Residual Value

Each method uses a different calculation to assign a dollar value to an asset’s depreciation during an accounting year. It uses the straight-line percentage on the remaining value of the asset, which results in a larger depreciation expense in the earlier years. Book value is the historical cost of an asset less the accumulated depreciation booked for that asset to date. This amount is carried on a company’s financial statement under noncurrent assets. https://www.facebook.com/BooksTimeInc/ On the other hand, salvage value is an appraised estimate used to factor how much depreciation to calculate.

How Is Salvage Value Calculated?

- You’ve “broken even” once your Section 179 tax deduction, depreciation deductions, and salvage value equal the financial investment in the asset.

- The useful life assumption estimates the number of years an asset is expected to remain productive and generate revenue.

- Laura Longero is an insurance expert and Executive Editor at CarInsurance.com, where she specializes in helping consumers navigate the complexities of the financial and insurance industries.

- This means it will result in a liability for a company to be rid of the asset at the end of its useful life.

- After tax salvage value is like the retirement money for a company’s equipment.

However, determining the exact value of a salvage vehicle often requires some legwork. For example, you might get estimates from local salvage yards to confirm the vehicle is worth more than the insurer’s estimate. “Repairing a salvage vehicle can be worth it if the cost of repairs is significantly lower than the vehicle’s post-repair market value,” says John Crist, founder of Prestizia Insurance. Check around with local salvage yards to https://www.bookstime.com/ ensure the salvage value the insurance company quoted you is correct for your vehicle. Another way to determine the value of a salvaged vehicle is to ask a local dealership what the car would be worth with a clean title.

best practices when using salvage values

For tangible assets, such as cars, computers, and machinery, a business owner would use the same calculation, only instead of amortizing the asset over its useful life, he would depreciate it. The initial value minus the residual value is also referred to as the “depreciable base.” The residual value, also known as salvage value, is the estimated value of a fixed asset at the end of its lease term or useful life. In lease situations, the lessor uses the residual value as one of its primary methods for determining how much the lessee pays in periodic lease payments. As a general rule, the longer the useful life or lease period of an asset, the lower its residual value. When calculating depreciation in your balance sheet, an asset’s salvage value is subtracted from its initial cost to determine total depreciation over the asset’s useful life.

What Is the Loss for Tax Value?

Each year, the depreciation expense is $10,000 and four years have passed, so the accumulated depreciation to date is $40,000. The difference between the asset purchase price and the salvage (residual) value is the total depreciable amount. Scrap value is the worth of a physical asset’s individual components when the asset itself is deemed no longer usable. The individual components, known as scrap, are worth something if they can be put to other uses.

- Depreciable assets are used in the production of goods or services, such as equipment, computers, vehicles, or furniture, and decrease in resellable value over time.

- To calculate the straight line basis, take the purchase price of an asset and then subtract the salvage value, its estimated value when it is no longer expected to be needed.

- The salvage value is used to determine annual depreciation in the accounting records, and the salvage value is used to calculate depreciation expense on the tax return.

- The depreciable amount is like the total loss of value after all the loss has been recorded.

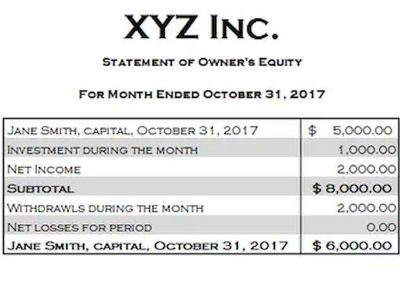

- In accounting, owner’s equity is the residual net assets after the deduction of liabilities.

The Financial how to get salvage value Accounting Standards Board (FASB) recommends using “level one” inputs to find the fair value of an asset. In other words, the best place to find an asset’s market value is where similar goods are sold, or where you can get the best price for it. Say that a refrigerator’s useful life is seven years, and seven-year-old industrial refrigerators go for $1,000 on average. The fridge’s depreciable value is $10,500 ($11,500 purchase price minus the $1,000 salvage value). The money I get back on my old phone is known as its salvage value, or its worth when I’m done using it. Get instant access to video lessons taught by experienced investment bankers.