Posting expenses directly to a cost of goods account or expense account do not follow generally accepted accounting principles and can create some tax issues down the road. For example, if you expense $100,000 in repairs one year for a net loss of $50,000 and the following year you report the sale of the property for $150,000. For example, a house flipper will use quickbooks differently than a property manager or landlord. House flipping has different best practices than managing rental properties in quickbooks. Gita Faust is a property landlord, an experienced property flipper, and a Certified Advanced QuickBooks ProAdvisor. When you purchase this manual, you’ll benefit from learning from her experience and knowledge.

Generally, 70% is the normal approach to assist house flippers to pay the best rate for fix-and-flip property to make cash. It is common, especially for landlords, to set up different limited liability companies (LLCs) for their individual properties. Many experienced real estate investors do this for asset protection. Unfortunately, this method lacks a level of reporting detail that is critical for investors. The method is often more suitable for the double declining balance ddb depreciation method definition house flipper that completes only a property or two per year.

- In the case of house flipping, we post rehab costs to the cost of goods account.

- You won’t make the mistake of flipping a property without a proper budget and tracking your expenses.

- A majority of repairs made during the operation of the property will go under the expense accounts and show up directly on your profit and loss statement.

How to Use QuickBooks for the Business of Flipping Houses?

Those who are rehabbing and flipping houses need a way to properly record expenses and costs into a cost of goods account that is realized upon the sale of a property. There are three main reasons real estate investors use quickbooks shareholder vs stakeholder for their real estate accounting needs. At the time of publication (2023) pricing for quickbooks is as low as $30 per month or $15 per month during promotional periods. This simplified accounting solution will transform your risky real estate flipping business into one that is thriving and built to deliver AMAZING profits at every flip – consistently and predictably. In Quickbooks, you can choose the Desktop version and theOnline version.

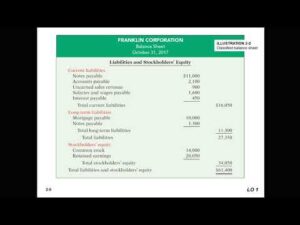

However, if you wish to build your income to acquire automated revenue, the best option for you is purchase rentals. It really varies on your real estate activity and investing type. Your average bookkeeper or accountant is likely going to persuade you into straight-line depreciation. Not necessarily because it’s better for you, but because it is easier for them. Also, your portfolio size is going to have an effect on how to set up your books. In addition, partnerships or private investors will also affect how you track, record, and manage your debts, cash flows, and balance sheet.

How to add new accounts

You have two options for depreciating your rental property. Of course, our cash flow statement will look very different. This example highlights the difference between cash accounting and accrual accounting. On the other hand, you might find yourself accountable to shareholders and investors depending on how you acquired capital for property acquisition. So, if you have questions or get stuck on one of the steps, we encourage you to reach out and ask for support. We’ll help you identify the issue and suggest ways to fix it.

Accounting for 1031 Like-Kind Exchange

I teach you everything you need to know to unlock the untapped power of QuickBooks, with all the necessary knowledge under your belt, you can make more profit buying, rehabbing, and flipping properties. Your accounting system acts as the powerhouse steering your triumph, and the one you opt for will be the decisive factor in your performance in buying, rehabbing, and flipping. Therefore, our primary sales income comes from the sale of these renovated properties. financing activities Because we buy and sell quickly, these properties are treated as inventory as opposed to fixed assets.

Real Estate Accounting Bootcamp

For instance, you may be using specific accounts such as Residential Sales or Commercial Sales, so you may have to modify your Chart of Accounts. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software. Join our network Today As our network grows, we’re able to send out more leads to agents in our network. Contact us to get help and support from our business specialists.

Some businesses prefer the desktop version because it hasmore features to cater to real estate transactions. However,Quickbooks Online continues to add features to make it easier to manage costsper project. When it comes to being a landlord, we need to post our rehab costs to a fixed asset account where we will incur depreciation over the lifetime use of the property.